Note: This for people investing or planning to invest in the Philippine Stock Exchange (PSE), although the principles can be applied to other stock exchanges.

Investing in the stock market has long since fascinated me. I love the idea of making money work for me, instead of me working for money. 😉

But without proper planning, you can lose a lot of money in the stock market. It’s so volatile that I put it off for years. I got inspired to finally start investing when Bo Sanchez told a story of how one of his maids became a multi-millionaire through investing in stocks through the years.

In this article, I will show you the lessons I learned in my stock investing journey and I hope it can help you in your journey to financial independence 🙂

My Story: How I Got Started With Stock Market Investing

I got started investing the same way most millennials following Bo Sanchez did — through the Truly Rich Club.

For those not familiar with the Truly Rich Club (TRC), it’s a subscription-based membership site by Bo Sanchez where he offers recommendation on which stocks to buy. But they recommend only 12 stocks at a time. It’s based on the Strategic Averaging Method (SAM), which is basically just like cost-averaging but with a twist. You don’t hold on to the stock for forever; once you hit the target price, you sell.

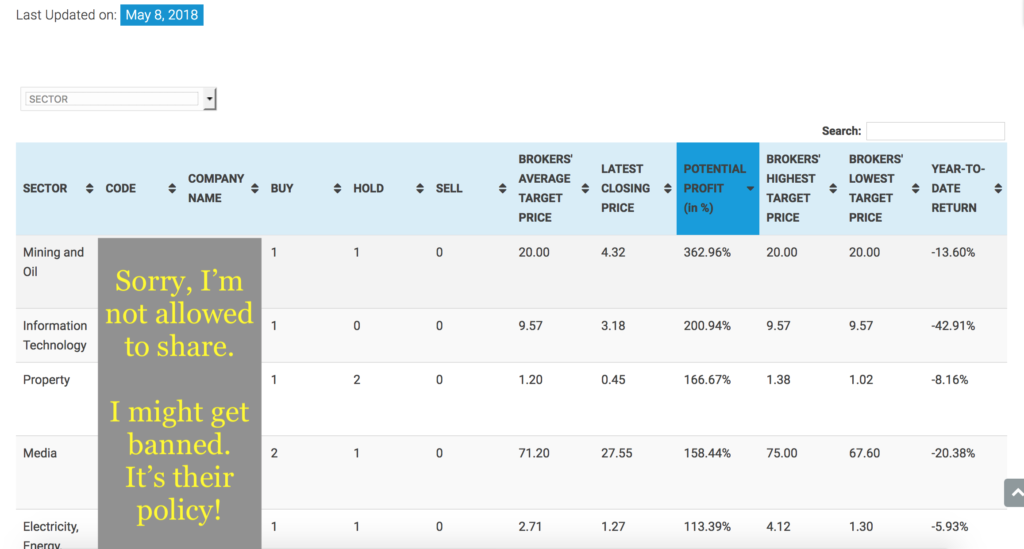

The SAM Table inside Truly Rich Club

I subscribed for 3 months. At ₱497 per month, I wasn’t investing consistently enough to justify paying the monthly subscription. At that time, most of the stocks recommended inside TRC were moving sideways.

Since I was using COL Financial as my online stockbroker, I discovered about their Investment Guide which they provide for their users. I realized that most stocks recommended inside TRC are the same. It makes sense because one of Bo Sanchez’ mentors when it comes to stock market investing is connected with COL Financial.

Bored and disappointed by the lack of action, I stopped investing in stocks and just let my current stock portfolio simmer.

How I Learned to Develop My Own Investing Strategy

After a 1-year hiatus (and just focusing on growing my online income) , I decided to get back into stock market investing. I wanted more freedom and options when it comes to stocks I invest in. So I set out to develop my own trading plan.

Here’s how I did it:

Capital appreciation or Dividends? Or Both?

First, figure out your goal. Do you want to buy stocks cheap so you can sell them for a profit later when the price rises? Or do you want to buy stocks paying high dividends? Or do you want to do both?

- Capital appreciation — buying stocks at low price, then sell them when their price goes up

- Dividends — you buy stocks with the main purpose of collecting dividends

Even dividend stocks pay higher rates than your average time deposits at the bank.

But how do I figure out which stocks to pick?

I don’t want to do technical analysis on tens to hundreds of stocks. How do I narrow my choices?

While searching the internet for any article that can help me, I realized that I can’t rely on public information in forums or Facebook groups. Some people hype up stocks and then take their profit leaving small-time investors in the dust.

I came across the website PinoyInvestor. They publish market analysis, as well as technical and fundamental stock analysis. I signed up for a free account to get a feel for the site. (Get access to FREE Special Reports by clicking here!)

Then I signed up for a 4-month PAID subscription as I was determined to invest consistently in the next few months. It was that time when I sold my highest-earning website and wanted to diversify my investments.

With the paid subscription, you get access to STOCK RANKINGS. You can sort stocks by SECTOR or MARKET CAPITALIZATION (large-cap, mid-cap, small-cap). The large cap stocks are less risky as these are bigger, more stable companies .

Stock Rankings inside Pinoy Investor

You can sort these columns (my favourite is the PROFIT POTENTIAL 😀 ) but I don’t completely rely on it. I still use my judgment and intuition 😉

Why do I prefer PinoyInvestor over Truly Rich Club?

First, I don’t want to be limited with my options. TRC only gives you 12 recommended stocks to choose from.

Second, with thousands of TRC subscribers, you’ll be competing with other members when say, your stock hits its target price. Stock prices are very volatile and can affected by a lot of factors.

Third, I still want to be guided on the TARGET PRICE and BUY BELOW price as I don’t want to do a comprehensive technical analysis.

Tools Needed:

Before we start choosing stocks, let me introduce you to the free tools I use to create my trading strategy and to monitor my stock portfolio.

1. Google Sheets

I use Google Sheets to create my trading plan.

2. Bloomberg App

This is the app I use to monitor my stock portfolio. It’s free to sign up. Once you’ve chosen which stocks to buy, add it to your ‘watchlist’. Since the app is in your phone, it’s easier to monitor the latest stock price and how your portfolio is doing.

How I Choose Stocks for Investing

I say investing because this strategy is for long term, not the usual stock trading strategy of buying and selling stocks with a day or a week. Trading stocks involves many technical analysis strategies that take a lot of time to study and implement.. time which I don’t have.

1. Pick 3-5 stocks.

I pick stocks from companies I know are fundamentally sound. Having a maximum of 5 stocks will make it easier and less confusing to monitor. You can certainly have more than 5 stocks, but it’ll be harder to manage.

2. Choose stocks from DIFFERENT SECTORS.

I only choose 1-2 stocks PER SECTOR to mitigate losses. Say for instance, the housing market is down, so if I have all 5 stocks in the PROPERTY sector, I’ll be doomed. My favorite sectors are property, telecom, power, banking and mining. What you end up choosing should be based on what you’re comfortable investing with.

3. Choose high-dividend yield stocks, but only when they’re cheap.

Since I aim to have both capital appreciation and dividends with my stocks, I include in my watchlist a few solid companies with a history of paying dividends. These are companies like Globe and PLDT. As they tend to be more expensive, I only buy them when they’re cheap.

Power and mining companies also tend to give out higher dividends. You can check the dividend yield on Bloomberg.

For dividend stocks, I choose those that have a dividend yield of 5% or higher. That means if you have ₱10,000 worth of stock from this company, your dividend would be ₱500.

How I Set My TARGET PRICE and BUY BELOW Price

The way I do it is, I use both COL Financial Investment Guide AND PinoyInvestor Stock Rankings for reference.

Then I use Bloomberg to see the chart.

Bloomberg data on Globe Telecom, with 5-year chart

I use the 5 year chart to see the general trend of the stock. It’s also helpful to see the highest price the stock has gone as that is a good indicator of how much it can potentially rise (very important since we buy when stocks are low — “buy low, sell high” is the mantra, right? 😉 )

Then I use the 52-week range to see if it’s the lowest (or at least near the lowest) the stock price has gone down in the past year.

If it is, then I buy it 🙂

How much time will it take to monitor stocks?

Once you have your trading plan set up, it’ll take you about 15 to 30 minutes once a month to check (and buy more stocks if you have the budget). Every time you buy stocks, put it in your WATCH LIST on the Bloomberg app. You have the option to put the date, # of stocks, and price bought.

While it’s better to be investing monthly into the stock market (and take advantage of cost averaging), you can still profit even if you don’t invest regularly. Take it from me.. Haha

Here’s a screenshot of my Stock Market Investing Tracker on Google Sheets

![]()

If you want a copy of this Google Sheet, you can get it here.

On Google Sheets, go to FILE, then click “make a copy” so you can have your own editable copy. 🙂

DISCLAIMER:

I’m not an expert at this; just sharing my own personal experience. Always invest with money you won’t need for a while (i.e, extra cash). Stock market investing is for long-term.

Got questions?

Leave a comment below!