When you work from home, it’s tempting to think you can just get away with NOT paying taxes. After all, you earn in $$$ and spend it in the Philippines thereby helping our economy, right?

Transitioning from being employed to working online for a foreign boss or for your yourself is hard enough. Add taxes to that and it becomes complicated.

When I registered with the BIR (which is the Philippine Tax Authority, for my international readers) in 2015, my local RDO (revenue district office) don’t even know what to do with me. One employee even asked me why I want to pay taxes if I earn money online?

Over 3 years ago, it was really a hassle as working online wasn’t recognise as a legitimate career. It was something you do as a hobby or as a way to earn money on the side.

But I insisted on getting registered. I had to learn how taxation works and how to file for taxes. Since I started traveling as a digital nomad, I’ve outsourced tax preparation and filing to a local accounting office.

Perks of going legit, registering your online business, and paying taxes

Here are my (selfish) reasons for getting registered and paying taxes:

1. You can apply for a credit card, get a personal loan, or apply for a car or house loan.

When you’re paying taxes, you have a tax record that shows you’re earning an income every month. Banks will be more likely to approve your loans if you can show them an ITR.

Let’s face it, we will be needing credit at some point.. whether we buy a house or car (well, unless you have a lot of cash! 😀 )

For those who pursue financial independence and want to have investments, especially in real estate, you definitely need an ITR. You need that to get a condo, or a house and lot.

Sure, maybe you can get away with having an ITR “cooked” up for you by many accountants or bookkeepers who offer this service. But BIR is going digital and there’s a platform for people to check your TIN. Those loopholes won’t be around for long.

2. Visa application

Truth be told, this was the main reason why I registered with the BIR in early 2015. I wanted to apply for a Japan Visa. I wanted to do it right and not get denied.

I’ve heard stories of people saying they were denied because they only showed proof of income (Odesk/Upwork/Paypal earnings).

As someone who wants to travel the world, this is very important to me. I’m happy to say that I was able to get a Japan visa (and went there in September 2015).

Now, three years later, I have multiple-entry visas for Japan, South Korea, and US.

>> Read more: How To Apply for South Korea Visa Without ITR, and How To Apply for US Visa in the Philippines

I think I got all these visa because I have a record of paying taxes for 3+ years now. This makes my online work / business look legitimate in the eyes of other countries’ governments. And that I won’t overstay or work illegally in their respective countries.

3. It is our legal duty to pay taxes for income earned, even from abroad.

This isn’t really a selfish reason but did you know that the Philippine Tax Code requires us to pay taxes on income earned even outside the Philippines? Of course, this is only for those who are residing in the Philippines.

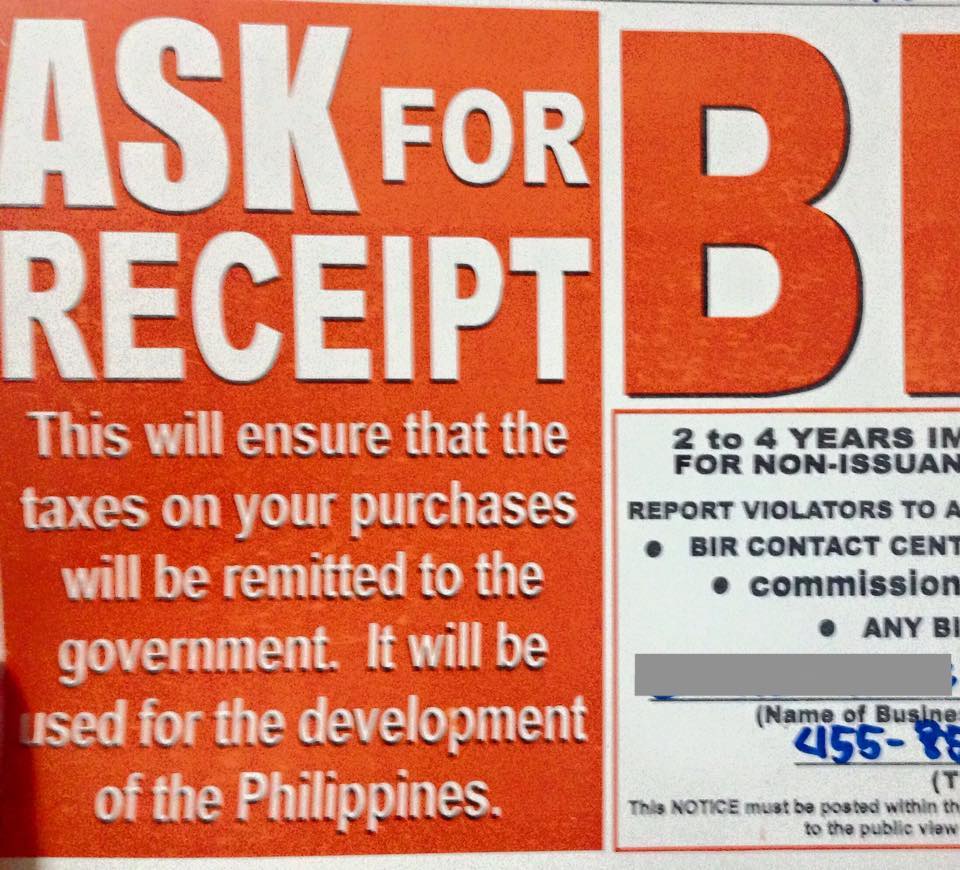

I’d like to think that I’m helping our country by paying taxes. Where else would the government get income to pay for public school teachers, nurses and doctors in public hospitals?

The state of our public school education or the quality of service in public hospitals is another matter. But for sure, you know at least one person who works for the government (in public schools, public hospitals, government offices) and gets paid by the government.

To Pay Or Not To Pay?

I’m sure most Filipinos would not pay taxes if they can get away with it. That kind of mentality has been so pervasive over the years.

But that is changing recently. And I’m happy with that.

Whether you do it for selfish reasons, or for love of country, I hope more and more online Filipino freelancers would register and pay taxes.

What do you think?

Any violent reactions? 😀 Leave a comment below!